1098-T FAQ

Instructions

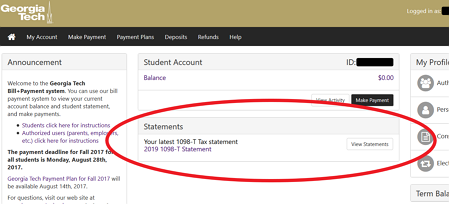

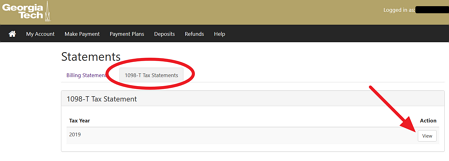

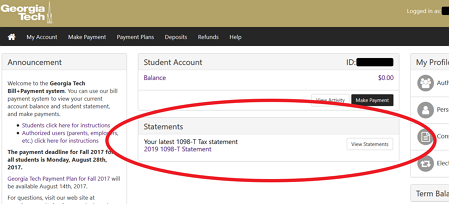

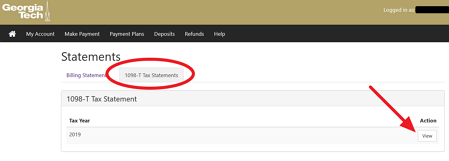

An email will be sent to your GT email address when the 1098-T is available. You may view and download your 1098-T through the student payment portal. Click on View Statements and the 1098-T Tax Statement tab to view and download your form.

1098-T

- What has changed on the 1098-T form?

- What is the 1098-T form?

- What are the Hope Scholarship Tax Credit and the Lifetime Learning Tax Credit?

- Where can I view my 1098-T information?

- Why is there nothing represented in Box 2 on my 1098-T?

- What charges are considered "qualified" or "eligible" charges?

- What charges are considered "non-qualified" charges?

- What is the timeline for the 1098-T?

- Why do my Spring semester payments not appear on my 1098-T?

- My 1098-T was mailed to the wrong address. How do I obtain a copy?

- Why was my 1098-T mailed to the wrong address?

- Do I actually submit the 1098-T with my tax return?

- How are VA Benefits reported on my 1098T form?

- I still have questions. Who can I contact?

What has changed on the 1098-T form?

In January of each year, Georgia Tech prepares IRS form 1098-T for eligible students reflecting amounts associated with tuition and financial aid for the prior calendar year as outlined in the IRS regulations.

In previous years, the 1098-T sent provided a figure in Box 2 of the form that represented the qualified tuition and related expenses (QTRE) that were BILLED to the student’s account for the calendar (tax) year. Due to a change to institutional reporting requirements mandated by federal law, beginning with tax year 2018, the amount of QTRE PAID during the calendar year will be reported in Box 1.

Please note that all payments received at the Bursar’s Office by December 31 will be posted to your student account to reflect for the current tax year. Payments that are made online to your student account in the Bill + Payment portal will post on the date the payment is made. Payments received after December 31, will be reported on the 1098-T form for the next tax year.

For more information about Form 1098-T, visit https://www.irs.gov/forms-pubs/about-form-1098-t

What is the 1098-T form?

The 1098-T form, also referred to as the "Tuition Payment Statement", is mailed to the student by Georgia Tech to assist you, the taxpayer, in determining if you are eligible to claim tax credits such as the Hope Scholarship Tax Credit or the Lifetime Learning Tax Credit for educational expenses.

What are the Hope Scholarship Tax Credit and the Lifetime Learning Tax Credit?

The Hope Scholarship Credit allows up to a $2,500 tax credit for the first four years of postsecondary education. The Lifetime Learning Credit allows up to a $2,000 tax credit per tax return for undergraduate, graduate and professional degree courses for eligible students. To review additional information about these two tax credits, go to https://www.irs.gov/forms-pubs/about-form-1098-t.

Where can I view my 1098-T information?

You may view and download your 1098-T through the student payment portal. An email will be sent to your GT email address when the 1098-T is available. Click on View Statements and the the 1098-T Tax Statement tab to view and download your form.

Why is there nothing reported in Box 2 on my 1098-T?

The IRS previously allowed institutions of higher education the option of reporting either payments received (Box 1) or qualified charges billed (Box 2). In years past, Georgia Tech elected to report qualified charges billed (Box 2). Due to a change to institutional reporting requirements mandated by federal law, beginning with tax year 2018, the amount of qualified tuition and related expenses (QTRE) paid during the calendar year in will be reported Box 1.

What charges are considered "qualified" or "eligible" charges?

Eligible or qualified charges are in-state or out-of-state tuition charges required for a student to be enrolled at or attend Georgia Tech and receive academic credit for the completion of course work leading to a degree. Certain fees are also qualified charges, including athletic, recreation, student activity, technology, USG institutional and testing fees.

What charges are considered "non-qualified" charges?

Non-qualified charges include books, housing, meal plans, health fee, insurance, or transportation fees or costs. Other examples of non-qualified charges include expenses incurred for a course to enhance job skills, improve language skills, or study abroad, unless a degree program requires studying abroad.

What is the timeline for the 1098-T?

The 1098-T form contains information pertaining to the calendar year (January 1st-December 31st).

Why do my Spring semester payments not appear on my 1098-T?

Payments made prior to January 1st of the current tax year cannot be reported on the current tax year 1098-T.

My 1098-T was mailed to the wrong address. How do I obtain a copy?

To obtain a 1098-T form, you may access the document at your student payment portal.

Why was my 1098-T mailed to the wrong address?

1098-T forms are mailed to the student's permanent residence listed in OSCAR. If your 1098-T was mailed to the wrong address, please make sure all information in OSCAR is currently up-to-date. You may update address information in OSCAR by:

- Click the Personal Information Box under the All Users option of the Ribbon Menu

- Click the pencil icon in the Address Box under the Permanent Address

Do I actually submit the 1098-T with my tax return?

There is no requirement for the 1098-T to be attached along with your tax return. This document may be kept for your personal records.

How are VA Benefits reported on my 1098T form?

Beginning in 2012, VA Benefits received under the Post 9/11 GI Bill are now reported as scholarships on the 1098-T form in Box 5. Although VA benefits are not considered a resource when need is calculated, the IRS has recently defined Box 5 to include payments received from governmental entities. The definition of Box 5 is:

The total amount of any scholarships or grants administered and processed during the calendar year for the payment of the student's costs of attendance. Scholarships and grants generally include all payments received from 3rd parties (excluding family members and loan proceeds). This includes payments received from governmental and private entities such as the Department of Defense, civic, and religious organizations, and nonprofit entities.

I still have questions. Who can I contact?

Any further questions can be directed to a representative in the Bursar's Office via email at: bursar.ask@business.gatech.edu or phone @ 404-894-4618. You may also want to consider viewing the following Web sites for more detailed information:

- http://www.irs.gov (type 1098-T in the search box)

- https://www.nasfaa.org/nasfaas_2017_higher_education_tax_benefit_guide

- IRS Publication 970, "Tax Benefits for Education"

Georgia Tech is not authorized to offer any personal tax advice. Please address all questions and concerns regarding personal tax matters to a tax consultant/advisor or the IRS directly @ 1-800-829-1040.